How Aerial Intelligence is Transforming Insurance Adjusters' Role

By Nearmap.

Nearmap aerial intelligence revolutionizes post-disaster claims with high-resolution imagery, enhancing efficiency and accuracy for insurance adjusters.

Property and casualty insurance companies are realizing the tremendous worth of aerial intelligence and imagery in post-disaster claims management. Adjusters are able to improve efficiency and accuracy while ensuring customer satisfaction by using high-resolution aerial imagery provided by companies like Nearmap. With aerial intelligence, Nearmap is able to help optimize the claims process and introduce an innovative approach for insurance companies to utilize post disaster.

Accelerate post-catastrophe response with aerial intelligence

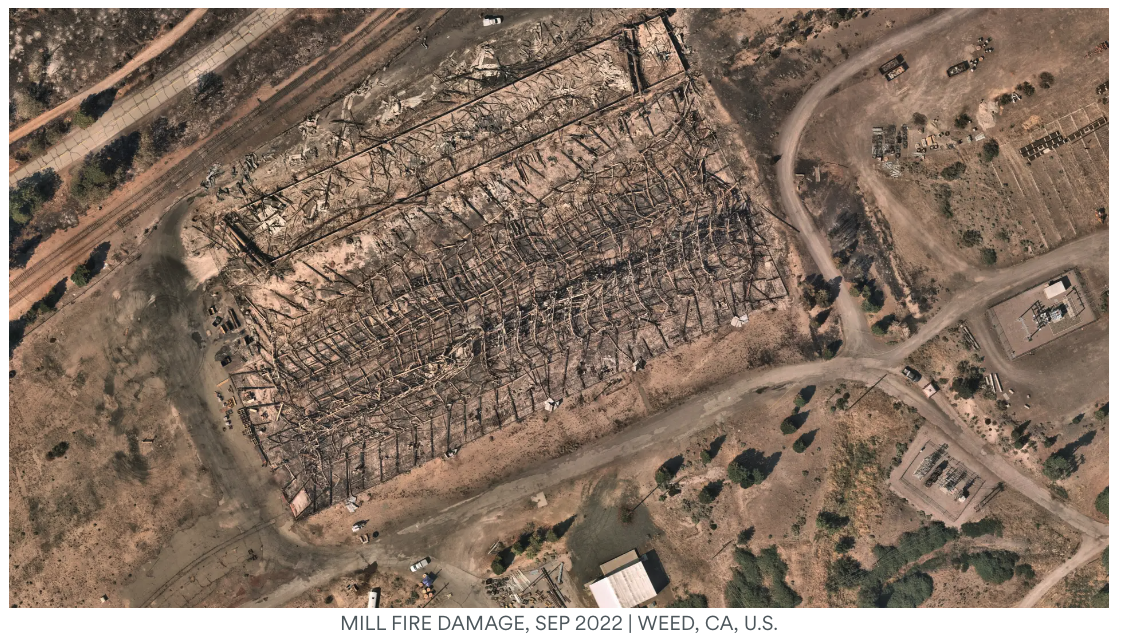

When disaster strikes, time is of the essence. Nearmap aerial intelligence and high-resolution post-disaster aerial images empower adjusters to rapidly assess damage, efficiently allocate resources, and quickly process a high-volume of claims. This technology enables adjusters to prioritize claims with the highest losses and make more effective use of even limited claims department personnel.

By swiftly and remotely identifying affected properties using aerial imagery, adjusters can also initiate the First Notice of Loss (FNOL) process, ensuring policyholders receive compensation faster — sometimes even before they realize the extent of the damage.

When claims are coming in, our claims reps take in the FNOL, look at the Nearmap image and can quickly see if it is going to be a large loss or if there are just a few shingles missing from a home.

In addition to accelerating the FNOL process, aerial imagery offers carriers invaluable insights into the overall condition of properties, helping identify potential hazards and informing policyholders of any necessary preventative measures. This proactive approach to risk management can significantly reduce the likelihood of future claims, ultimately benefiting carriers, adjusters and policyholders alike.

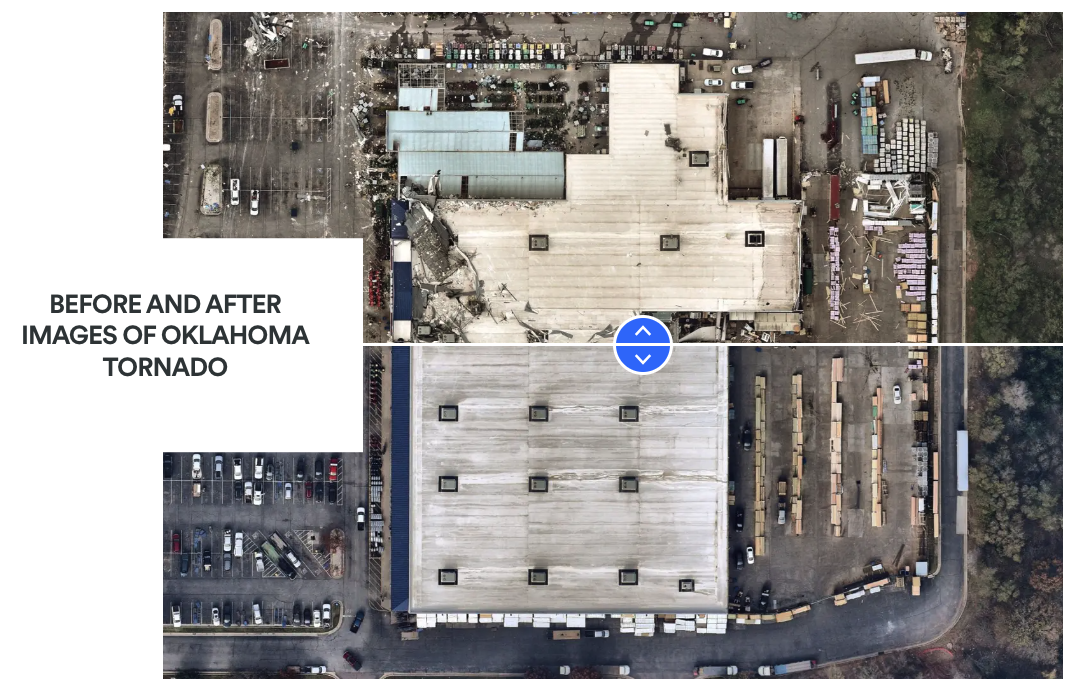

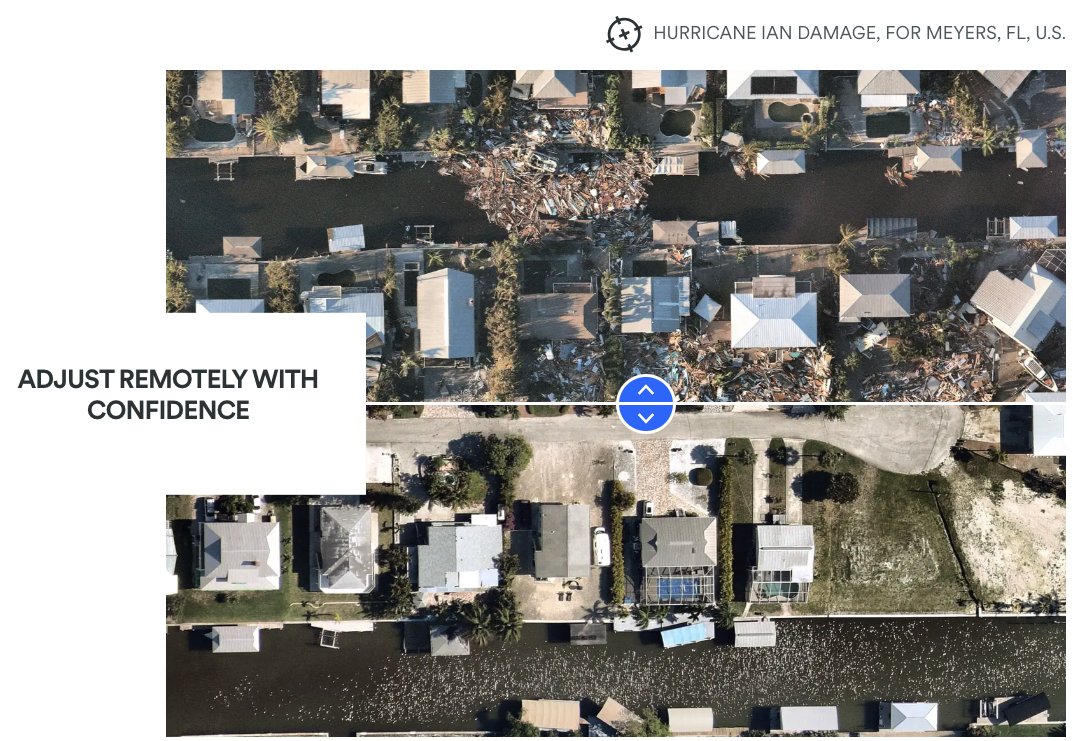

Moreover, the use of aerial imagery in the FNOL process allows adjusters to access a clear and accurate record of property conditions, facilitating a more transparent claims resolution process. By comparing pre- and post-disaster images, adjusters can determine the exact extent of the damage, ensuring fair compensation for policyholders, minimizing disputes and providing carriers with a visual source-of-truth for litigation.

Empower commercial insurance adjusters with aerial intelligence

Commercial insurance adjusters have a unique set of challenges when it comes to assessing damage for their policyholders as commercial properties can be more complex and varied than residential properties. Aerial intelligence and imagery offers a powerful solution for adjusters who may encounter claims that they are not fully responsible for covering. Historical imagery allows adjusters to more fully understand the pre-claim condition of a property.

By leveraging high-resolution aerial imagery, commercial insurance adjusters can remotely inspect properties in great detail, identifying hazards that may not be visible or apparent from ground level. For instance, excessive pallet stacking, debris accumulation or improper storage of hazardous materials can pose significant risks to commercial (and residential) properties, potentially leading to fires, structural damage or environmental issues.

Nearmap aerial intelligence and imagery can support commercial insurance adjusters in validating the claims information provided by clients, ensuring that payouts for the claim are based on the post-coverage damage and not damage sustained before their policy. This data-driven approach can lead to more accurate claims resolutions that benefit carriers, adjusters and policyholders.

Transform property inspections with high-resolution imagery

Aerial intelligence and high-resolution imagery have the potential to revolutionize property inspection processes for adjusters, offering a more efficient and cost-effective alternative to traditional on-site inspections. By leveraging this cutting-edge visual technology, adjusters can remotely evaluate property damage, including potential roof damage, without the need for time-consuming and potentially hazardous on-site visits.

For example, adjusters can utilize aerial imagery to inspect roofs for signs of loss, such as missing shingles, holes and other issues This remote evaluation not only eliminates the need for on-site inspections but also significantly reduces associated expenses, such as travel costs and the potential liability that comes with physically accessing a roof. This method provides adjusters with a safer and more efficient way to conduct inspections, leading to faster claims processing and improved customer satisfaction.

By incorporating aerial intelligence into their workflows, adjusters can more accurately assess properties to determine the appropriate level of compensation required while reducing the overall costs associated with the claims inspection process. This innovative approach not only streamlines operations for insurance providers but also results in a more efficient and customer-centric claims process, bolstering customer satisfaction and trust in the carrier.

Nearmap aerial intelligence and high-resolution imagery offer a multitude of benefits for Property and Casualty Insurance Adjusters, elevating their efficiency, accuracy, and customer service capabilities. By integrating Nearmap into their workflows, adjusters can excel in post-catastrophe response, optimize workflows, and ensure fair claims resolutions. Embracing this technology will place the Property and Casualty Insurance industry at the forefront of innovation and customer satisfaction, setting a higher standard for adjusters and policyholders alike.

Original article source: Nearmap

Learn more about Nearmap in their Coffee Shop Directory or visit www.nearmap.com.

About Nearmap

Nearmap provides easy, instant access to high-resolution aerial imagery, city-scale 3D content, AI data sets, and geospatial tools. Using its own patented camera systems and processing software, Nearmap captures wide-scale urban areas in the United States, Canada, Australia, and New Zealand several times each year, making current content instantly available in the cloud via web app or API integration. Every day, Nearmap helps thousands of users conduct virtual site visits for deep, data-driven insights—enabling informed decisions, streamlined operations and better financial performance. Founded in Australia in 2007, Nearmap is one of the largest aerial survey companies in the world and is publicly listed on the Australian Securities Exchange (ASX:NEA).

Comments

Leave a Reply

Have an account? Login to leave a comment!

Sign In