GCP Reports Second Quarter 2022 Financial and Operating Results

Despite supply chain setbacks, GCP's second quarter highlights show an increase in net sales.

GCP Inc. (NYSE: GCP) (GCP or the Company), a leading global provider of construction products, today announced preliminary financial and operating results for the second quarter 2022.

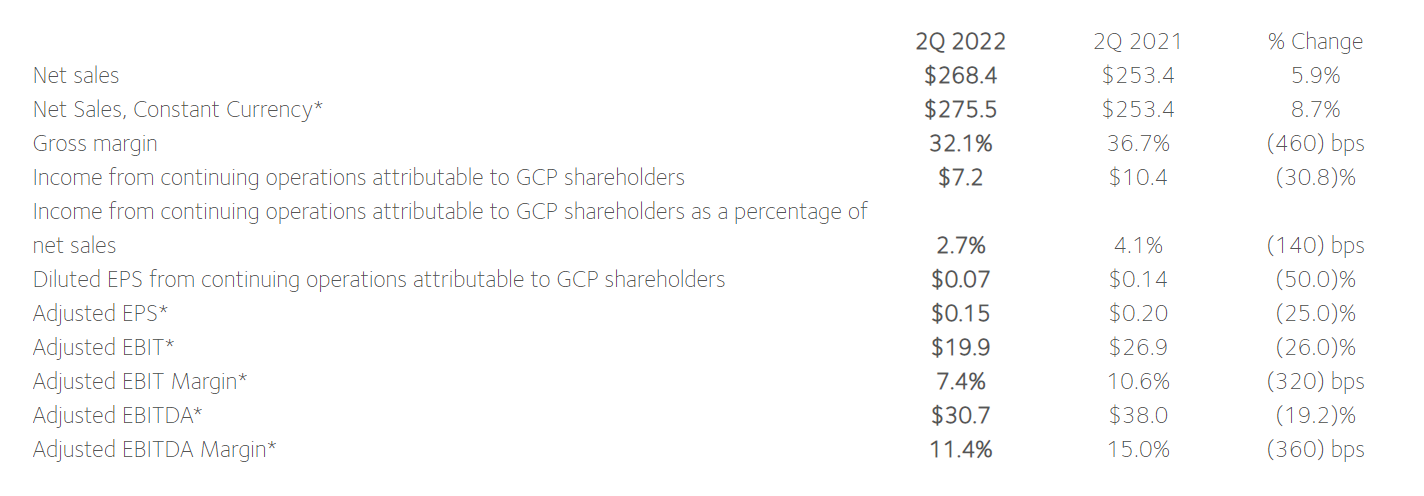

Second Quarter 2022 Highlights

- Net sales of $268.4 million, an increase of 5.9%

- Selling, general and administrative expenses of $64.7 million, an increase of 0.8%

- Income from continuing operations attributable to GCP shareholders of $7.2 million

- Adjusted EBIT* of $19.9 million

- Adjusted EBITDA* of $30.7 million

- Diluted EPS of $0.07

- Adjusted EPS* of $0.15

For the three months ended June 30, 2022, GCP reported net sales of $268.4 million compared with $253.4 million in the prior-year quarter. Net Sales Constant Currency* were $275.5 million versus $253.4 million, an increase of 8.7% over the prior-year quarter. Income from continuing operations attributable to GCP shareholders was $7.2 million in the second quarter of 2022 compared with income of $10.4 million in the prior-year quarter, while Adjusted EBIT* was $19.9 million, a decrease of 26.0% versus prior-year quarter. Adjusted EBITDA* totaled $30.7 million, a decrease of 19.2% over the prior-year quarter. Diluted earnings per share from continuing operations attributable to GCP shareholders was $0.07 compared with $0.14 in the second quarter of 2021, while Adjusted EPS* was $0.15 compared with $0.20 in the prior-year quarter.

"Our earning's performance in the quarter was impacted by a series of supply chain disruptions and significant additional cost inflation, including the spike in global oil prices. Our teams have worked hard to effectively navigate the supply chain issues and we have implemented a series of price increases," commented Simon Bates, GCP's President and Chief Executive Officer. "Despite the positive price, volume, and operating improvements, the cost of inflation and freight costs continued to impact SCC's results in the quarter as pricing lagged due to contractual customer obligations. We expect the actions we have taken to positively impact our results in the third and fourth quarter of 2022, and into 2023".

Total GCP Applied Technologies ($ millions)

Second Quarter 2022 Financial Update

- Net sales were $268.4 million, an increase of 5.9% compared with the prior-year quarter primarily attributable to favorable pricing and volume, partially offset by foreign currency adjustments.

- Gross margin was 32.1%, a decrease of 460 basis points compared with the prior-year quarter, primarily due to higher raw material and logistics costs. Gross margin improved sequentially 130 basis points from the first quarter.

- Selling, general and administrative costs were $64.7 million, an increase of 0.8% compared with the prior-year quarter, primarily due to lower employee-related costs resulting from restructuring programs and lower incentive compensation costs. These favorable impacts were partially offset by higher merger and other acquisition-related costs.

- Income from continuing operations attributable to GCP shareholders was $7.2 million compared with $10.4 million in the prior-year quarter.

- Adjusted EBIT* was $19.9 million, a decrease of 26.0% compared with the prior-year quarter, primarily due to lower Specialty Construction Chemical ("SCC") and lower Specialty Building Material ("SBM") operating income. Adjusted EBIT Margin* decreased by 320 basis points to 7.4% compared with the prior-year quarter.

- Adjusted EBITDA* was $30.7 million, a decrease of 19.2% compared with the prior-year quarter. Adjusted EBITDA Margin* decreased by 360 basis points to 11.4% compared with the prior-year quarter. The decrease was due to lower Adjusted EBIT*.

Second Quarter 2022 Segment Performance

Specialty Construction Chemicals ($ millions)

- Net sales were $158.3 million, an increase of 9.5% compared with the prior-year quarter due primarily to the favorable impact of price and volume increases, partially offset by foreign currency translation.

- Gross margin decreased 640 basis points to 29.7% compared with the prior-year quarter primarily due to higher raw material and logistic costs.

- Segment operating margin decreased 490 basis points compared with the prior-year quarter primarily due to higher raw materials costs.

Specialty Building Materials ($ millions)

- Net sales were $110.1 million, an increase of 1.2%, compared with the prior-year quarter primarily due to the favorable impact of price increases. North America increased volumes by 8.4%, offset by decreases in Latin American, Asia Pacific and EMEA.

- Gross margin decreased 220 basis points to 35.9% from the prior-year quarter primarily due to higher raw material costs.

- Segment operating margin decreased 270 basis points compared with the prior-year quarter primarily due to higher raw material costs.

Capital Allocation and Liquidity

GCP's cash balance at the end of the second quarter 2022 was $459.4 million.

Investor Call

In light of GCP's entry into a definitive merger agreement with Saint-Gobain in December 2021, GCP will not host a conference call or webcast to discuss its second quarter 2022 results.

About GCP Applied Technologies

GCP Applied Technologies (NYSE: GCP) is a leading global provider of construction products that include high-performance specialty construction chemicals and building materials. GCP partners with producers, contractors, designers and engineers to achieve performance and sustainability goals. The company has a legacy of first to market and award-winning solutions that have been used to build some of the world’s most renowned structures. GCP is focused on continuous improvement for its customers, end-users and the environment. For more information, visit GCP's website at www.gcpat.com.

Forward Looking Statements

This announcement contains “forward-looking statements,” within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934 and the Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the context of the statement and generally arise when GCP or its management is discussing its beliefs, estimates or expectations. Such statements generally include the words “believes,” “plans,” “intends,” “targets,” “will,” “expects,” “estimates,” “suggests,” “anticipates,” “outlook,” “continues,” or similar expressions. These statements are not historical facts or guarantees of future performance but instead represent only the beliefs of GCP and its management at the time the statements were made regarding future events which are subject to certain risks, uncertainties and other factors, many of which are outside GCP’s control. Actual results and outcomes may differ materially from what is expressed or forecast in such forward-looking statements. Forward-looking statements include, without limitation, statements about expected financial positions; results of operations; cash flows; financing plans; business strategy; operating plans; strategic alternatives; capital and other expenditures; competitive positions; growth opportunities for existing products; benefits from new technology and cost reduction initiatives, plans and objectives; the potential impacts of global supply chain disruptions, increased cost inflation and potential price increases; and markets for securities. Like other businesses, we are subject to risks and uncertainties that could cause our actual results to differ materially from our projections or that could cause other forward-looking statements to prove incorrect, including, without limitation, risks related to: the cyclical and seasonal nature of the industries that GCP serves; foreign operations, especially in emerging regions; changes in currency exchange rates; business disruptions due to public health or safety emergencies, such as the novel strain of coronavirus ("COVID-19") pandemic; the cost and availability of raw materials and energy; the effectiveness of GCP’s research and development, new product introductions and growth investments; acquisitions and divestitures of assets and gains and losses from dispositions; developments affecting GCP’s outstanding liquidity and indebtedness, including debt covenants and interest rate exposure; developments affecting GCP’s funded and unfunded pension obligations; warranty and product liability claims; legal proceedings; the inability to establish or maintain certain business relationships and relationships with customers and suppliers or the inability to retain key personnel; the handling of hazardous materials and the costs of compliance with environmental regulations; extreme weather events and natural disasters. These and other factors are identified and described in more detail in GCP's Annual Report on Form 10-K for the year ended December 31, 2021 as well as GCP’s subsequent filings and quarterly reports and is available online at www.sec.gov. Readers are cautioned not to place undue reliance on GCP’s projections and other forward-looking statements, which speak only as of the date thereof. GCP undertakes no obligation to publicly release any revision to its projections and other forward-looking statements contained in this announcement, or to update them to reflect events or circumstances occurring after the date of this announcement.

Recommended For You

Polyglass Extends a Warm Invitation to Connect With us at the 2023 Chicago Build Expo

Read More ...

Polyglass Joins Roofing Professionals on Capitol Hill to Support and Advocate for the Roofing Industry

Read More ...

Trade Association Coalition Announces Q3 Findings from Market Index Survey for Reroofing

Read More ...

Comments

Leave a Reply

Have an account? Login to leave a comment!

Sign In